Tucson Short Sale in Tucson Short Sales Homes in Arizona

» CALL (520) 204-4223 «

UPDATE: MyOwnArizona can get people into a new home 1 day out of foreclosure or bankruptcy! And we have current Short Sale/Foreclosure listings to send you: (520) 222-6929 or info@MyOwnArizona.com

FREE: We have current Short Sale/Foreclosure listings (520) 222-6929

Tucson Arizona Short Sales in Real Estate

The City of Tucson, Arizona has over 700 short sales properties in real estate currently available. This is a great opportunity to invest in one of the most sought-after areas in the real estate market today. Arizona Bank Foreclosures & Government Foreclosed Houses, REO, Federal Homes, Distressed Properties, and Commercial Foreclosures are all at MyOwnArizona.com. All foreclosures, HUD, VA, and other government property home lists and listings are available as well.

The City of Tucson, Arizona has over 700 short sales properties in real estate currently available. This is a great opportunity to invest in one of the most sought-after areas in the real estate market today. Arizona Bank Foreclosures & Government Foreclosed Houses, REO, Federal Homes, Distressed Properties, and Commercial Foreclosures are all at MyOwnArizona.com. All foreclosures, HUD, VA, and other government property home lists and listings are available as well.

Find all the Arizona foreclosure properties by selecting the links below. Search our entire MLS database of Arizona foreclosures free as long as you like with no obligation. Keep checking back with us since the system is updated twice daily.

⇒ All Tucson Arizona Short Sales in Real Estate ⇐

⇒ All Tucson Arizona Short Sales in Real Estate ⇐

Bidding on a property at a foreclosure auction on the local courthouse steps can be overwhelming and intimidating -- it's often an experience unlike any other. It also takes a good amount of time, skill and resources. At MyOwnArizona.com, we've got a better alternative. An MyOwnArizona™ Real Estate Foreclosure Specialist represents a tremendous opportunity to purchase foreclosed homes at reduced prices directly from lenders through our sales staff. It is free to view these amazing deals and the bid process is fast and simple.

Bidding on a property at a foreclosure auction on the local courthouse steps can be overwhelming and intimidating -- it's often an experience unlike any other. It also takes a good amount of time, skill and resources. At MyOwnArizona.com, we've got a better alternative. An MyOwnArizona™ Real Estate Foreclosure Specialist represents a tremendous opportunity to purchase foreclosed homes at reduced prices directly from lenders through our sales staff. It is free to view these amazing deals and the bid process is fast and simple.

MyOwnArizona.com is the main source of foreclosure properties in the State of Arizona that updates all properties twice daily. As an agent, investor, or homebuyer, MyOwnArizona.com delivers the foreclosure information needed. Contact us at any time for assistance.

![]()

The Basics: Arizona Short Sales

Due to current economic conditions, the number of Arizona short sale properties on the Arizona market is rising. The increasing number of Arizona short sales on the Arizona market presents challenges for Arizona Realtors. Below you'll find more information on: Arizona short sales and their Arizona challenges, the government's efforts to address these challenges, and tools to help you navigate the Arizona short sale process.

Home Affordable Foreclosure Alternatives Program (HAFA) in Arizona

To help Arizona homeowners who are unable to keep their Arizona homes under the Home Affordable Modification Program in Arizona, the HAFA program may make an Arizona short sale or an Arizona deed-in-lieu of Arizona foreclosure a viable option to help them avoid Arizona foreclosure. The HAFA Program in Arizona, which will take effect on April 5, 2010, provides servicer, seller and junior lien holder incentives for these Arizona transactions and is designed to simplify and streamline use of Arizona short sales and Arizona deeds-in-lieu of foreclosure.

What is an Arizona short sale?

An Arizona short sale is a transaction in which the Arizona lender, or Arizona lenders, agree to accept less than the mortgage amount owed by the current Arizona homeowner. In some cases, the difference is forgiven by the Arizona lender, and in others the Arizona homeowner must make arrangements with the lender to settle the remainder of the debt.

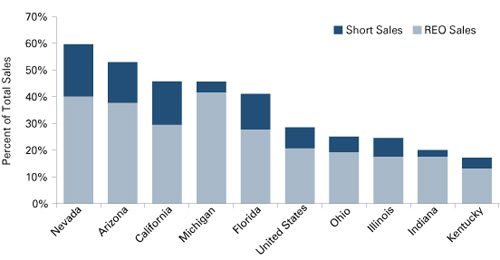

Why is the number of Arizona short sales rising?

Due to the recent economic crisis, including rising unemployment, and drops in Arizona home prices in communities across the nation, the number of Arizona short sales is increasing. Since an Arizona short sale generally costs the lender less than an Arizona foreclosure, it can be a viable way for an Arizona lender to minimize its losses.

An Arizona short sale can also be the best option for an Arizona homeowners who are "upside down" on mortgages because an Arizona short sale may not hurt their credit history as much as an Arizona foreclosure. As a result, Arizonan homeowners may qualify for another mortgage sooner once they get back on their feet financially.

What challenges have short sales presented for Arizona Realtors?

The rapid increase in the number of Arizona short sales, and the Arizona short sales process itself present a number of challenges for Arizona Realtors. Major challenges include:

(1) Limited experience: Many Arizona Realtors are new to the Arizona short sales process; a difficulty which is compounded by many lenders' lack of sufficient and experienced staff to process short sales. Even if the Arizona Realtors are experienced, most servicers are under-staffed and still not adequately trained, making negotiating a short sale particularly difficult.

(2) Absence of a uniform process and application: Until HAFA guidelines were established, both Arizona short-sales documents and processes were Arizona lender-specific, making it very difficult and time-consuming for Arizona Realtors to become knowledgeable and efficient in facilitating these transactions.

(3) Multiple lenders: When more than one lender is involved, the negotiations are much more difficult. Second lien holders often hold up the transaction to exert the largest possible payment, in exchange for releasing their lien, even though in Arizona foreclosure they will get nothing.

As a result of these challenges our fellow Arizona Realtors have reported difficulties with: unresponsive Arizona lenders; lost documents that require multiple submissions, inaccurate or unrealistic Arizona home value assessments, and long processing delays, which cause Arizona buyers to walk away. MyOwnArizona has the solutions for you.

What is being done to address or eliminate these challenges?

HAFA is designed to address many of the Arizona challenges presented by Arizona short sales. For more information contact us about NAR's Home Affordable Foreclosure Alternatives Program in Arizona.

![]()

The MyOwnArizona™ Team Does More Than Help People Buy and Sell Tucson Real Estate

Contact us at: info@MyOwnArizona.com for Tucson & Southern Arizona foreclosed and short sales properties real estate.

Mortgage Calculator:

|

||||||||||||||||||

Real Estate Cities MLS Searches in Southern Arizona

- » All Arizona Cities

- Tucson AZ Real Estate

- Oro Valley AZ Real Estate

- Marana AZ Real Estate

- Green Valley AZ Real Estate

- Vail AZ Real Estate

- Sahuarita AZ Real Estate

- Benson AZ Real Estate

- Tubac AZ Real Estate

- Pearce AZ Real Estate

- Rio Rico AZ Real Estate

- San Manuel AZ Real Estate

- Sonoita AZ Real Estate

- Bisbee AZ Real Estate

- » All Arizona Types

- New Homes For Sale in AZ

- Land For Sale in Arizona

- Arizona Gated Communities

- Golf Communities in Arizona

- Horse Property For Sale AZ

- Condos Townhomes in AZ

- Retirement Communities AZ

- Lofts For Sale in Arizona

- Residential Income Property

- Commercial Real Estate AZ

- » All Arizona Communities

- Catalina Foothills in AZ

- Dove Mountain Real Estate

- Ventana Canyon Resort AZ

- La Paloma in Tucson AZ

- Sam Hughes Neighborhood

- Mt Lemmon Cabins in AZ

- Pima Canyon Estates

- Saddlebrooke in Arizona

- Sun City in Arizona

- Rancho Vistoso in Arizona

- Continential Ranch in AZ

- Stone Canyon in Arizona

- Civano in Arizona

- * Site updated twice daily.

» CALL (520) 204-4223 «

Tucson | Oro Valley AZ | Marana AZ | Green Valley AZ | Vail AZ | Sahuarita AZ | Benson AZ | Tubac AZ | Pearce AZ | Rio Rico AZ

New Homes | Land | Gated Communities | Golf Communities | Horse Property | Condos Townhomes | Retirement | Lofts | Residential

Catalina Foothills AZ | Dove Mountain AZ | Ventana Canyon AZ | La Paloma AZ | Sam Hughes | Mt Lemmon | Pima Canyon Estates

Saddlebrooke AZ | Sun City Vistoso AZ | Rancho Vistoso AZ | Continental Ranch AZ | Stone Canyon AZ | Civano AZ

AZ Foreclosures | Foreclosures in Tucson AZ | Tucson Short Sales | Oro Valley Foreclosures | Phoenix Real Estate

© Copyright 1995-2014. OwnArizona LLC. Tucson Real Estate. Oro Valley Real Estate. All Rights Reserved.