Arizona Home Loans with Bad Credit Modification Loan Program

» CALL (520) 204-4223 «

The MyOwnArizona™ Network of Tucson Mortgage Loan Lenders

|

• Conventional Loan • No Income Verification Loan • No Down Payment Loan • Credit Problems Loan • 30-Year Fixed Rate Loan • 15-Year Fixed Rate Loan • Adjustable Rate Loan • Hybrid ARM Loan • Adjustable Rate Mortgage • 2/1 Buy Down Mortgage • Annual ARM Loan • Monthly ARM Loan • Negative Amortization Loan • 103% Purchase Loan • 80/15/5 Loan |

• Stated Income Loan • JUMBO Loan • A Thru D Loans • High Debt Ratio Loan • 2nd Mortgage Loan • Construction Loans • Investor Loan • FHA Mortgage Loan • Flex 97 Loan • Home Equity Line Loan • Balloon Loan • Bridge Loan • VA Mortgage Loan • Reverse Mortgage Loan |

Tucson Conventional Loan: Traditional loan programs that usually require 5% down and offer competitive interest rates. Documentation and fair-to-good credit are necessary. » APPLY FOR TUCSON CONVENTIONAL LOAN

Tucson No Income Verification Loan: Loans where your income is not requested or verified with as little as 10% down are stated income loans. There are several varieties of the "no-doc" loan today. The type of loan that is best suited for a particular borrower depends on that borrower's situation. Some borrowers choose not to disclose employment, income, or asset information, while others may be willing to disclose employment and asset information but not income. Still others might be willing to disclose income but select a program that doesn't calculate debt-to-income ratios, allowing those borrowers to exceed the traditional guidelines in order to qualify for a larger mortgage amount. With all the different variations of the no-doc mortgage loan, there is definitely a mortgage program for today's non-conventional borrowers. » APPLY FOR TUCSON NO INCOME VERIFICATION LOAN

Tucson No Income Verification Loan: Loans where your income is not requested or verified with as little as 10% down are stated income loans. There are several varieties of the "no-doc" loan today. The type of loan that is best suited for a particular borrower depends on that borrower's situation. Some borrowers choose not to disclose employment, income, or asset information, while others may be willing to disclose employment and asset information but not income. Still others might be willing to disclose income but select a program that doesn't calculate debt-to-income ratios, allowing those borrowers to exceed the traditional guidelines in order to qualify for a larger mortgage amount. With all the different variations of the no-doc mortgage loan, there is definitely a mortgage program for today's non-conventional borrowers. » APPLY FOR TUCSON NO INCOME VERIFICATION LOAN

Tucson No Down Payment Loan: 0% down payment required and closing costs paid by the borrower (seller can contribute up to 6% towards closing costs).

» APPLY FOR TUCSON NO DOWN PAYMENT LOAN

Tucson Credit Problems Loan: Troubled credit? Bankruptcy? Been turned down somewhere else? We offer mortgage loan programs for customers with credit problems. » APPLY FOR TUCSON CREDIT PROBLEMS LOAN

Tucson Thirty-Year Fixed Rate Mortgage Loan: The traditional 30-year fixed-rate mortgage has a constant interest rate and monthly payments that never change. This may be a good choice if you plan to stay in your home for several years. If you plan to move earlier, then adjustable-rate mortgage loans are usually less expensive. As a rule of thumb, it may be harder to qualify for fixed-rate mortgage loans than for adjustable rate loans. When interest rates are low, fixed-rate loans are generally not that much more expensive than adjustable-rate mortgages and may be a better deal in the long run, because you can lock in the rate for the life of your mortgage loan. » APPLY FOR TUCSON THIRTY-YEAR FIXED LOAN

Tucson Fifteen-Year Fixed Rate Mortgage Loan: This mortgage loan is fully amortized over a 15-year period and features constant monthly payments. It offers all the advantages of the 30-year mortgage loan, plus a lower interest rate, and you'll own your home twice as fast. The disadvantage is that, with a 15-year mortgage loan, you commit to a higher monthly payment. Many borrowers opt for a 30-year fixed-rate mortgage loan and voluntarily make larger payments that will pay off their mortgage loan in 15 years. This approach is often safer than committing to a higher monthly payment, since the difference in interest rates isn't that great. » APPLY FOR TUCSON FIFTEEN-YEAR FIXED LOAN

Tucson Adjustable Rate Mortgage Loan: Sometimes it is more important for you to have a lower initial rate, resulting in a lower payment, so that you will be able to qualify for the home you have chosen. Perhaps you plan to move in a few years and are not concerned about possible interest rate increases. Maybe you are confident that your income will increase enough in the coming years to compensate for periodic increases in your interest rate, and subsequently larger mortgage payments that accompany an adjustable rate mortgage loan (ARM). » APPLY FOR TUCSON ADJUSTABLE RATE LOAN

Tucson Adjustable Rate Mortgage Loan: Sometimes it is more important for you to have a lower initial rate, resulting in a lower payment, so that you will be able to qualify for the home you have chosen. Perhaps you plan to move in a few years and are not concerned about possible interest rate increases. Maybe you are confident that your income will increase enough in the coming years to compensate for periodic increases in your interest rate, and subsequently larger mortgage payments that accompany an adjustable rate mortgage loan (ARM). » APPLY FOR TUCSON ADJUSTABLE RATE LOAN

Tucson Hybrid ARM Loan: These increasingly popular ARM -- also called 3/1, 5/1 or 7/1 -- can offer the best of both worlds: lower interest rates (like ARMs) and a fixed payment for a longer period of time than most adjustable rate mortgage loans. For example, a "5/1 loan" has a fixed monthly payment and interest for the first five years and then turns into a traditional adjustable-rate mortgage loan, based on then-current rates for the remaining 25 years. It's a good choice for people who expect to move (or refinance) before or shortly after the adjustment occurs.

» APPLY FOR TUCSON HYBRID ARM LOAN

Tucson 2/1 Buy Down Mortgage Loan: The 2/1 buy-down mortgage allows the borrower to qualify at below market rates so they can borrow more. The initial starting interest rate increases by 1% at the end of the first year and adjusts again by another 1% at the end of the second year. It then remains at a fixed interest rate for the remainder of the mortgage loan term. Borrowers often refinance at the end of the second year to obtain the best long-term rates. However, keeping the mortgage loan in place even for three full years or more will keep their average interest rate in line with the original market conditions. » APPLY FOR TUCSON 2/1 BUY DOWN LOAN

Tucson Annual ARM Loan: This mortgage loan has a rate that is recalculated once a year. » APPLY FOR TUCSON ANNUAL ARM LOAN

Tucson Monthly ARM Loan: With this mortgage loan, the interest rate is recalculated every month. Compared to other options, the rate is usually lower on this ARM because the lender is only committing to a rate for a month at a time, so his vulnerability is significantly reduced. » APPLY FOR TUCSON MONTHLY ARM LOAN

Tucson Negative Amortization (neg. AM) Loan: This is a deferred-interest mortgage loan which is very powerful -- and the most misunderstood mortgage program because of its many options. Basically, the lender allows the borrower to make monthly payments that are less than the accruing interest. Therefore, if the borrower chooses to make the minimum monthly payment, the mortgage loan balance will increase by the amount of interest not paid on the mortgage loan. The power of this mortgage loan lies in the borrower's ability to choose between making the full mortgage loan payment, or the minimum payment, or any amount in between. If a borrower's income varies throughout the year (due to commissions, bonuses, etc.), The borrower can make a lower payment during the "lean times", and then make higher payments when funds are readily available. » APPLY FOR TUCSON NEGATIVE AMORTIZATION LOAN

Tucson Negative Amortization (neg. AM) Loan: This is a deferred-interest mortgage loan which is very powerful -- and the most misunderstood mortgage program because of its many options. Basically, the lender allows the borrower to make monthly payments that are less than the accruing interest. Therefore, if the borrower chooses to make the minimum monthly payment, the mortgage loan balance will increase by the amount of interest not paid on the mortgage loan. The power of this mortgage loan lies in the borrower's ability to choose between making the full mortgage loan payment, or the minimum payment, or any amount in between. If a borrower's income varies throughout the year (due to commissions, bonuses, etc.), The borrower can make a lower payment during the "lean times", and then make higher payments when funds are readily available. » APPLY FOR TUCSON NEGATIVE AMORTIZATION LOAN

Tucson 103% Purchase Loan: Down payment required and closing costs can be financed up to 103% of the purchase price. Only single-family homes that will be owner-occupied are eligible. First time homebuyer status not required and there are no income limits. » APPLY FOR TUCSON 103% PURCHASE LOAN

Tucson 80/15/5 Loan: This is a mortgage loan which carries a second mortgage for up to 15% of the purchase price of the property. It is usually used when wishing to avoid PMI insurance or to keep your first mortgage under the FNMA/FHLMC limit to avoid JUMBO rates. The borrower puts down a 5% down payment and then finances a first mortgage up to the FNMA/FHLMC limit and a second mortgage of up to 15% of the purchase price. Other variations are 80/10/10 or 75/15/5. » APPLY FOR TUCSON 80/15/1 LOAN

Tucson Stated Income - Zero Down Loan: 100% stated income mortgage loans are typically for people with extremely good credit (high FICO scores). These are zero down mortgage loans, because the borrower is financing 100% of the mortgage loan. Stated income basically indicates that the lender is not going to verify income and/or assets. These mortgage loans are excellent for self-employed borrowers with good credit. » APPLY FOR TUCSON STATED INCOME LOAN

Tucson JUMBO Loan: If a conventional mortgage loan falls within Fannie Mae's and Freddie Mac's mortgage loan limits, it is referred to as a conforming mortgage loan. If the mortgage loan amount exceeds the maximum permissible mortgage loan amount of these two agencies, it is called a JUMBO, or non-conforming mortgage loan. Offers 30 and 15 year fixed rate mortgage and competitive ARM products with full document, alternate documentation and limited documentation. Cash out and no cash out refinance are allowable. Single family detached, condo's, PUD's and single-family second homes can be financed with no prepayment penalty. Conventional lenders typically insist that the borrower put down more than 20% on a JUMBO mortgage loan. Interest rates on JUMBO mortgage loans generally run between 3/8% to 1/2% higher than conforming mortgage loans. The difference in the interest rate between conforming and JUMBO mortgage loans is higher when mortgage money is not plentiful. The difference typically decreases with the abundance of mortgage money. » APPLY FOR TUCSON JUMBO LOAN

Tucson A Thru D Loans: These mortgages are for the credit challenged. They can vary from slightly damaged credit to severely damaged. Whatever the situation we have a mortgage that will get you back on track. » APPLY FOR TUCSON A THRU D LOANS

Tucson High Debt Ratio Loan: A ratio of monthly bills to monthly income higher than 50% is considered a high debt ratio. Loan programs are available for borrowers in this situation, allowing them to finance the purchase of a home or property. » APPLY FOR TUCSON HIGH DEBT LOAN

Tucson 2nd Mortgage Loan: Subordinate to the first mortgage these mortgage loans offer the borrower the ability to get money for home improvement, debt consolidation or many other reasons without disturbing their first mortgage. Convenient when you have a low interest first mortgage. » APPLY FOR TUCSON 2ND MORTGAGE LOAN

Tucson Construction Loans: Building a new home can be an exciting prospect - unless you get caught up in a construction mortgage loan approval process that's overly complicated and time consuming.

Tucson Construction Loans: Building a new home can be an exciting prospect - unless you get caught up in a construction mortgage loan approval process that's overly complicated and time consuming.

One Time Close Construction Loan

When rates are low it's the ideal time to take advantage of the one time close construction mortgage loan. Your rate will never change from the beginning of construction through the life of the mortgage loan. And, you pay only one set of closing costs. » » APPLY FOR TUCSON ONE TIME CLOSE CONSTRUCTION LOAN

Tucson Two Time Close Construction Loan

When interest rates are on the rise, it's usually better to do a two time close construction loan because the initial loan covers only the cost of construction and can be configured as an "interest only" loan. 3/1 Or 5/1 ARMs (adjustable rate mortgages, fixed for 3 or 5 years), are usually recommended for this purpose because they traditionally carry a lower interest rate. Lower interest rates help to keep payments low during the construction process. With a two time close construction loan, you are charged with 2 sets of closing costs, one for the construction loan and another for the permanent loan. However, some lenders will waive costs on the construction loan if you commit to doing the permanent loan with them. With a two time close, you also have the option to lock your permanent rate at the time the construction loan is originated, with a "float down" option. At the end of construction, you have the option of choosing the locked rate or the current rate for your permanent loan, whichever is lower. » APPLY FOR TUCSON TWO TIME CLOSE CONSTRUCTION LOAN

Tucson New Construction Loan

Construction loans used for new homes generally pay the builder or general contractor in installments or "draws", as each previously agreed upon stage of construction is satisfactorily completed. Interest is paid by the borrower on these construction funds as they are dispersed. After completing a project, the construction financing is usually converted into a permanent, long-term mortgage.

» APPLY FOR TUCSON NEW CONSTRUCTION LOAN

Other Consideration Loans

Construction loans may also be the most appropriate choice for extensive remodeling projects because in most cases, they provide the owner with more money than can be accessed from the home's equity through a cash-out refinance. » APPLY FOR TUCSON OTHER CONSTRUCTION LOANS

Tucson Investor Loans: Used to finance 1-4 family properties that will be for investment with as little as a 10% down payment. Aggressively priced these programs have many variations such as no doc, limited doc and full doc. » APPLY FOR TUCSON INVESTOR LOAN

Tucson FHA Mortgage Loan: Backed by the department of housing and urban development, this mortgage offers the borrower the ability to put as little as 3% down payment -- and they can even finance "allowable" closing costs. Seller can contribute up to 6% of the purchase price to the buyer towards closing costs. » APPLY FOR TUCSON FHA MORTGAGE LOAN

Tucson Flex 97% Loan: Similar to FHA but without maximum mortgage amount limitations. Must be a single family, owner occupied home and borrower must have a credit score of over 680. » APPLY FOR TUCSON FLEX 97% LOAN

Tucson Home Equity Line Of Credit Loan: Home Equity Line Of Credit (aka HELOC) equity can be defined as the difference between what your house is worth in today's market, and how much you currently owe for the property. For example, if your home is appraised at $225,000 and you have an outstanding balance of $75,000, then you have $150,000 of home equity. With this in mind, a Home Equity Line Of Credit Loan is basically a line of credit secured by a second mortgage on a property. You can borrow against what you have already paid, so long as you don't exceed the maximum loan amount previously agreed to by you and the lender.

» APPLY FOR TUCSON HELOC LOAN

Tucson Balloon Loan: Balloon Loans require level payments (such as a Fixed Rate Loan), but come due before their maturity rate (typically three to ten years after the start date). When a Balloon Loans comes due, the loan's entire remaining principal balance is due and payable. Balloon Loans often offer a lower rate of interest in comparison to a fixed rate loan, but they can be risky, since refinancing is not always an option. » APPLY FOR TUCSON BALLOON LOAN

Tucson Bridge Loan: If you find yourself in the position of having to buy a new house before selling your old one, you may benefit from a Tucson Bridge Loan. Bridge Loans enables you to borrow against the equity that is tied up in your old home until it sells. There are several risk factors to consider before deciding that a Bridge Loans is right for you. If your old house doesn't close quickly, you could wind up paying for two houses longer than you had anticipated. This effectively forces you to pay three mortgages (the first one for your old home, the second for the Bridge Loans and the third for your new home). Combine this with the prospect of paying two property tax bills, two premiums for homeowners insurance and two sets of utility bills. These can add up quickly. One more potential pitfall is the state of the market. If property prices plummet while you're still trying to sell the old house, you may not be able to sell it for enough money to pay off all your outstanding loans. The holder of the Bridge Loans may then be able to foreclose on your new home to make up for the shortfall. » APPLY FOR TUCSON BRIDGE LOAN

Tucson VA Loan: United States Department of Veteran's Affairs (VA) Loans allow qualified veterans to buy a house without a down payment. Backed by the Veterans Administration and the Federal Government, it is similar to FHA except that you have to be a qualified veteran or military person. Additionally, the qualification guidelines for VA loans are more flexible than for either FHA or conventional loans. MyOwnArizona™ network Tucson loan officers will be able to answer your questions and determine which options will be the most advantageous for you. » APPLY FOR TUCSON VA LOAN

Tucson Reverse Mortgage Loan: A "Reverse" Mortgage is a loan against your Tucson home that you do not have to pay back for as long as you live there. With a Tucson Reverse Mortgage, you can turn the value of your home into cash without having to move or to repay the loan each month. The cash you get from a Reverse Mortgage can be paid to you in several ways:

• All at once, in a single lump sum of cash.

• As a regular monthly cash advance.

• As a "credit line" account that lets you decide when and how much of your available cash is paid to you.

• As a combination of these payment methods.

No matter how this loan is paid out to you, you typically don't have to pay anything back until you die, sell your home, or permanently move out of your home. To be eligible for most Reverse Mortgage, you must own your home and be 62 years of age or older.

Comparison With Other Home Mortgage Loans

To qualify for most home mortgage loans, the lender checks your income to see how much you can afford to pay back each month. But with a Tucson Reverse Mortgage, you don't have to make monthly repayments. So you don't need a minimum amount of income to qualify for a Reverse Mortgage. You could have no income and still be able to get a Reverse Mortgage. With most home loans, you could lose your home if you don't make your monthly payments. But with a Tucson Reverse Mortgage, there aren't any monthly repayments to make. So you can't lose your home by not making them. Most Tucson Reverse Mortgage require no repayment for as long as you -- or any co-owner(s) -- live in the home. » APPLY FOR TUCSON REVERSE MORTGAGE LOAN

Applying for MyOwnArizona Network Loans is easy, please fill out:

MyOwnArizona™ Network of Lenders

Contact us at: info@MyOwnArizona.com for Tucson & Southern Arizona real estate.

The market commentary material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without error.

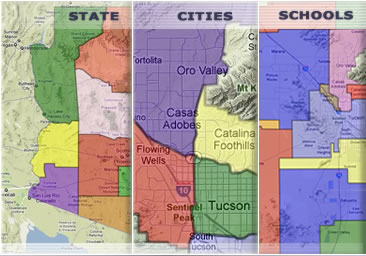

Real Estate Cities MLS Searches in Southern Arizona

- » All Arizona Cities

- Tucson AZ Real Estate

- Oro Valley AZ Real Estate

- Marana AZ Real Estate

- Green Valley AZ Real Estate

- Vail AZ Real Estate

- Sahuarita AZ Real Estate

- Benson AZ Real Estate

- Tubac AZ Real Estate

- Pearce AZ Real Estate

- Rio Rico AZ Real Estate

- San Manuel AZ Real Estate

- Sonoita AZ Real Estate

- Bisbee AZ Real Estate

- » All Arizona Types

- New Homes For Sale in AZ

- Land For Sale in Arizona

- Arizona Gated Communities

- Golf Communities in Arizona

- Horse Property For Sale AZ

- Condos Townhomes in AZ

- Retirement Communities AZ

- Lofts For Sale in Arizona

- Residential Income Property

- Commercial Real Estate AZ

- » All Arizona Communities

- Catalina Foothills in AZ

- Dove Mountain Real Estate

- Ventana Canyon Resort AZ

- La Paloma in Tucson AZ

- Sam Hughes Neighborhood

- Mt Lemmon Cabins in AZ

- Pima Canyon Estates

- Saddlebrooke in Arizona

- Sun City in Arizona

- Rancho Vistoso in Arizona

- Continential Ranch in AZ

- Stone Canyon in Arizona

- Civano in Arizona

- * Site updated twice daily.

» CALL (520) 204-4223 «

Tucson | Oro Valley AZ | Marana AZ | Green Valley AZ | Vail AZ | Sahuarita AZ | Benson AZ | Tubac AZ | Pearce AZ | Rio Rico AZ

New Homes | Land | Gated Communities | Golf Communities | Horse Property | Condos Townhomes | Retirement | Lofts | Residential

Catalina Foothills AZ | Dove Mountain AZ | Ventana Canyon AZ | La Paloma AZ | Sam Hughes | Mt Lemmon | Pima Canyon Estates

Saddlebrooke AZ | Sun City Vistoso AZ | Rancho Vistoso AZ | Continental Ranch AZ | Stone Canyon AZ | Civano AZ

AZ Foreclosures | Foreclosures in Tucson AZ | Tucson Short Sales | Oro Valley Foreclosures | Phoenix Real Estate

© Copyright 1995-2014. OwnArizona LLC. Tucson Real Estate. Oro Valley Real Estate. All Rights Reserved.