Tucson Boom in US Real Estate Investments

Two dozen people lined the walls of the living room, their backs to the windows and the sweeping Catalina Mountains views.

They were there not to admire the vistas, but to inspect the home and then to bid on it. Yesterday’s auction at 6350 N. Placita Arista was one of thousands of home auctions that have taken place since the real estate market plummeted. The house, like increasing numbers of other homes, was bought by a real estate investor.

Investors made up 27 percent of all single-family, condo and co-op purchases last year, according to the National Association of Realtors.

Investors are certainly busy in Tucson. Realtor.com recently named the city the top market in the country for investors on the basis of homes’ affordability and the city’s relatively low unemployment rate of 7.8 percent. The national average is 8.2 percent. Forbes magazine also reported the findings.

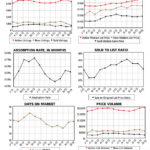

Local real estate experts agree that Tucson is a bustling market for investors and that the market is heating up. Inventories have shrunk to about four months’ worth, with six months considered normal, said Kevin Kaplan, who crunches housing data for Long Realty. Properties, especially those with listed prices under $200,000, are now often receiving multiple bids and going for above the listed price.

“I think we’ve had a big shift in the last 90 days,” Kaplan said. “We’re about six months behind Phoenix, and nutty things are happening there. It’s almost like it was at the height of the market.”

A shift has also occurred in who the investors are. The stereotype of investors as professionals buying low, fixing homes up and selling high is breaking down. “In 2004 and 2005, investors were looking to flip,” Kaplan said. “I think now the investor is buying to rent and hold.”

Increasingly, investors are regular people looking to augment their income with a rental property or two, not professional flippers. “For the most part, they’re normal, everyday people with a little extra cash,” said Brent VanKoevering, a real estate agent for Long Realty whose clients are now mostly investors. “They see great opportunities and are scared of the stock markets. Some have already had rentals.”

The top bidder on the auctioned home on Placita Arista fits that profile. Rolando Verduzco was the highest bidder with an offer of $335,000 for the four-bedroom, three-bathroom home. He’s awaiting final approval by the seller. He is a Realtor with HomeSmart International and an investor in rental properties, though he plans to live on Placita Arista because he likes the La Paloma Ridge neighborhood, just north of the Westin La Paloma Resort & Spa.

“It’s the perfect time to buy here,” he said. “I like the community feel in a big city.” Other investors share a similar sentiment. Frederick Shaffer, a certified public accountant who also attended the auction, said he is investing in homes and land because he thinks the market has bottomed out. “The location is great,” he said. “Prices, especially for land right now, are low because financing is so hard to get. It’s great if you can pay cash.”

Home affordability is at the highest level in the 42 years that the National Association of Realtors has been tracking it. The median home price in Tucson in 2011 was $134,500, compared with $166,200 nationally, said Walter Molony, a National Association of Realtors spokesman. There are little local data on what proportion of sales went to investors, but Kaplan of Long Realty said that about 40 percent of the company’s recent sales were paid in cash, an indication that the buyer is likely an investor.

Carl F. Pepper, Realtor

carl@MyOwnArizona.com

www.MyOwnArizona.com

(520) 822-6575

Posted in

Posted in  Tags:

Tags: