Tucson Foreclosure Deficiency Laws Deficiency Foreclosures Tucson Arizona Law Process Bank Mortgage Help

» CALL (520) 204-4223 «

NEW FLASH: MyOwnArizona can get people into a new home 1 day out of foreclosure or bankruptcy!

Facing Foreclosure in Arizona?

The national real estate market is slowing. Interest rates are ticking up. And the phones are ringing at Tucson credit counselor, as Tucson homeowners start to panic about not being able to make their mortgage payments. The number of Tucson residents asking for appointments to talk about foreclosure is definitely up. Rising rates are really putting a crunch on Tucson homeowners with adjustable-rate loans.

The national real estate market is slowing. Interest rates are ticking up. And the phones are ringing at Tucson credit counselor, as Tucson homeowners start to panic about not being able to make their mortgage payments. The number of Tucson residents asking for appointments to talk about foreclosure is definitely up. Rising rates are really putting a crunch on Tucson homeowners with adjustable-rate loans.

Nearly a quarter of the nation's mortgages have rates scheduled to reset this year or next, which means higher payments for millions of homeowners. How many will default isn't known, but the Mortgage Bankers Association, which tracks delinquencies and foreclosures, expects a "modest" uptick in both by the end of the year. If you're in danger of falling behind on your mortgage, or if you're already delinquent, it's important to know what's ahead and what your options are. Usually, the faster you move, the more choices you'll have about your financial future in Tucson.

Your Tucson Foreclosure Timeline

30 days: Your Tucson Foreclosure troubles actually start as soon as you miss a single payment. Tucson lenders may not contact you until you've skipped a second Tucson mortgage payment, but most will report the first late Tucson mortgage payment and every subsequent delinquency to the credit bureaus. Even a single late Tucson mortgage payment can devastate your credit score, the three-digit number that lenders use to help gauge your credit worthiness. Each subsequent "late" further decreases your score, making it more difficult and expensive to get a loan or a Tucson mortgage refinance that might help your situation. In addition, Tucson mortgage lenders typically tack on late fees of 5% or so for each missed payment.

90 days to one year: Eventually, if the Tucson mortgage payments aren't made, the Tucson lender will file a "notice of default" with the Tucson courthouse and send you a letter saying that the Tucson foreclosure process will start unless you make good the missing Tucson mortgage payments. How quickly the notice is filed depends on the individual Tucson lender. Some Tucson mortgage lenders will hold off if you contact them to work out a Tucson mortgage payment plan or otherwise explain your situation. Others are more aggressive and start the process as soon as possible to try to protect their investment.

Tucson mortgage lenders may do it as early as 90 days, or as late as a year. It really depends on the Tucson mortgage lender's temperament. And usually, this notice means that the amount you owe has shot up as well, since the Tucson lender typically adds substantial fees to cover its legal costs. The notice of default is a big threshold. Once you get into that position, it's a whole different world. Your options are fewer.

Tucson mortgage lenders may do it as early as 90 days, or as late as a year. It really depends on the Tucson mortgage lender's temperament. And usually, this notice means that the amount you owe has shot up as well, since the Tucson lender typically adds substantial fees to cover its legal costs. The notice of default is a big threshold. Once you get into that position, it's a whole different world. Your options are fewer.

The notice of default is generally picked up by the credit bureaus, further depressing your credit score and making refinancing your Tucson mortgage loan extremely difficult. In addition, the notice tips off scam artists that you're in trouble and may be vulnerable to various "equity skimming" schemes. One common ploy: The scam artist promises to take over your payments, but instead rents out your Tucson home and keeps the rent payments as pure profit. Your Tucson home goes into Tucson foreclosure, your credit is trashed and you've lost any equity you had in the Tucson home.

90 days more: Tucson borrowers typically have 90 days from the notice of default to make up the deficit before the Tucson lender sends out a "notice of sale," which sets a sale date for the your Tucson home (typically within the next 15 to 30 days). Some Tucson lenders will allow you to keep your original Tucson mortgage loan if you can make up the missing Tucson mortgage payments plus any late fees and legal charges. Other Tucson lenders will insist you in a Tucson mortgage refinance with another Tucson lenders. You can also halt your Tucson foreclosure, at least temporarily, by filing a lawsuit or filing for bankruptcy. For either legal option to work, you'll have to be able to come up with a Tucson mortgage payment plan to fix the deficit.

![]()

Your Tucson Foreclosure Options

Tucson mortgage lenders today typically offer a variety of solutions for people who have fallen behind on their Tucson mortgage. Here is our experience:

(1) Temporarily reducing or waiving your Tucson mortgage payments.

(2) Setting up short-term repayment plans to help you make up the deficit.

(3) Adding the unpaid balance to the principal of your Tucson mortgage loan and increasing your Tucson mortgage payments slightly to cover the extra amount.

ACT QUICKLY

If you have certain types of Tucson mortgage loans, you may have even more options. If you have a mortgage insured by the Federal Housing Administration, for example, you may qualify for an interest-free (and payment-free) Tucson mortgage loan to get your mortgage current. The money doesn't need to be paid back until you pay off the mortgage or sell the house.

If you have certain types of Tucson mortgage loans, you may have even more options. If you have a mortgage insured by the Federal Housing Administration, for example, you may qualify for an interest-free (and payment-free) Tucson mortgage loan to get your mortgage current. The money doesn't need to be paid back until you pay off the mortgage or sell the house.

If you can work out a solution with the Tucson mortgage lender quickly enough, you can contain or even avoid serious damage to your credit. That's among the reasons MyOwnArizona typically urges you to call your Tucson mortgage lender as soon as you know you'll have trouble making a Tucson mortgage payment.

This is good advice, but trickier than it may seem at first, for two reasons:

(1) Tucson mortgage lenders can make it tough to get to the right people. The folks you want to talk to are in the "loss mitigation" department. But many Tucson mortgage lenders don't routinely route Tucson borrowers to that department until they've missed several payments. Until then, you might be dealing with the Tucson mortgage lender's collections department, which typically offers one option: Pay up now. If you're serious about keeping your Tucson home, you may have to really push to get to right people. The Tucson loss mitigation department is where the options are really going to open up.

(2) You have to be able to make the Tucson mortgage payments. If you agree to a Tucson mortgage lender's "workout" or "loan modification" solution and then fail to make the agreed-upon payments, you'll be in a world of hurt. At best, you'll have "a lot fewer options the second time around. More likely the Tucson mortgage lender will simply accelerate the Tucson foreclosure process.

This can be a big problem if the financial crisis that caused you to fall behind isn't over. If you don't know where you're going to get the money to make the Tucson mortgage payments, trying to work out a solution with your Tucson lender will be tough. If you're honest like that, Tucson mortgage lenders are not going to want to work with you. If you're dishonest, you breach the Tucson mortgage agreement.

That's no reason to hide from your Tucson mortgage lender or ignore their letters. Even if you can't work out an agreement, keeping in contact is usually the right choice: at least you know where you stand. Filing a Tucson lawsuit or bankruptcy carries similar risk: If you don't have the money to make the payments, the Tucson foreclosure can proceed, and you may have further damaged your credit score.

![]()

Steps to Get Out of The Tucson Foreclosure Mess

So what to do? First, you'll need to take a hard, clear-eyed look at your financial situation. To that end: make a budget. Sketch out a spending plan for the next several months, including expected income and expenses. See what costs you can trim to free up as much money as possible for Tucson home mortgage payments. You may need to pay the minimums, or even less, on other debts. In certain very limited circumstances -- such as when you are absolutely sure your financial hardship will be short-lived -- it may make sense to skip payments on some bills so you can pay your Tucson mortgage. Another option: borrowing money from friends or family, or tapping retirement funds. Do the latter only if you're convinced you can make future payments; you don't want to drain your retirement funds if you're only going to end up losing yur Tucson house.

Consider getting help. Legitimate credit counseling services, those associated with the National Foundation for Credit Counseling or the Association of Independent Consumer Credit Counseling Agencies, typically have housing counselors that can help you evaluate your options. Or you can find a housing counseling agency approved by the Housing and Urban Development Department by calling (800) 569-4287. If you have a Veterans Administration loan, you can call (800) 827-1000 to get a referral to a financial counselor.

Check your Tucson mortgage refinance options. If you have equity in your Tucson home, your credit rating is relatively intact and your Tucson mortgage lender hasn't yet filed a notice of default, you may be able to get another Tucson mortgage loan with more affordable payments. An experienced Tucson mortgage broker, preferably one affiliated with the National Association of Mortgage Brokers, can let you know your options. Be cautious about jumping into another risky loan though: as an adjustable, interest-only or "option" mortgages might just put off the day of reckoning and you could find yourself facing even higher payments down the road.

Be realistic. Many times people struggle to hang on to a Tucson house that they simply can't afford when they'd be far better off without it. Some people are just too tied to their Tucson homes. It's just property. That may seem harsh, but it's far better to sell a Tucson home while you still have equity and some semblance of a credit score than to have it taken away in a Tucson foreclosure.

Get organized. If you are going to try for a Tucson mortgage loan modification, you'll need to prepare a small amount of documentation. The Tucson lender will specify what they want, but typically you'll need to supply the details of your financial situation, a budget, documentation of your hardship (a letter from your doctor explaining an income-reducing illness, for example, or your layoff notice from your Tucson employer) and a "hardship letter" that outlines, in detail, the circumstances that led you to fall behind and the improved prospects that will allow you to get your financial life back on track.

You may also want (or be required) to provide a market analysis of your house to document how much equity you have in your Tucson home. A MyOwnArizona real estate agent can typically prepare this for FREE in exchange for your business should you decide to sell: (520) 222-6929 or info@MyOwnArizona.com

Leaving Your Tucson Home

Leaving Your Tucson Home

If a Tucson mortgage loan modification or Tucson mortgage loan refinance isn't possible or feasible, your options come down to these:

Sell the Tucson house. If you have enough equity in your Tucson home to allow you to pay off your Tucson mortgage in full, after deducting any Tucson real estate agent commissions, then a Tucson "quick sale" is usually your best option. You'll preserve what's left of your credit score and your equity, leaving you in a much better position should you want to buy another Tucson home in the future. Please contact a MyOwnArizona real estate agent to get started right away as the process can take a while: (520) 222-6929 or info@MyOwnArizona.com

Offer a deed in lieu of Tucson foreclosure. If you can't sell the Tucson house for what you owe, but you're not deeply "upside down" on your Tucson mortgage, this may be an option: you propose handing over the deed to your Tucson home and your Tucson lender agrees to release you from your Tucson mortgage. This usually keeps you from having to pay any deficit that might be owed on the Tucson property, while the Tucson lender avoids further legal costs related to a Tucson foreclosure.

Tucson mortgage lenders can't be forced to accept a deed, however. Typically, Tucson mortgage lenders require that the Tucson borrower make "a really good effort" to sell the Tucson home first, and show that their delinquency was due to "unavoidable hardship" before they'll agree to a deed in lieu of Tucson foreclosure. Please contact our Tucson Foreclosure and Tucson Short Sales experts at MyOwnArizona to get started right away as the process can take a while: (520) 222-6929 or info@MyOwnArizona.com

Negotiate a Tucson Short Sale. If you owe substantially more on your Tucson home than it's worth, you may be able to get the Tucson lender to accept less than it is owed by negotiating a Tucson "short sale." You essentially sell the Tucson house for whatever you can get, and the Tucson lender agrees to accept the proceeds and not go after you for the deficit. Immediately contact our Tucson Short Sales experts at MyOwnArizona to get started right away as the process can take a while: (520) 222-6929 or info@MyOwnArizona.com

A short sale can further damage your credit scores, often showing up as a "settlement" that indicates you paid less than you owed. You may also face an IRS bill on the unpaid debt, which is generally considered income to you. A skilled MyOwnArizona Tucson Short Sales negotiator may be able to avoid these consequences or at least minimize them, so you may want to consider having our experts find you an experienced attorney's help.

Allow the Tucson Foreclosure to proceed. This is generally the worst choice. In some states and in some circumstances, the Tucson lender can even go after you in court for any deficit between what the Tucson house eventually sells for and what you owe. An MyOwnArizona housing counselor can let you know if that's a possibility: (520) 222-6929 or info@MyOwnArizona.com

Even if the worst happens, though, the damage to your financial life needn't be permanent. If your situation improves, you may be able to get another Tucson mortgage lender, at a reasonable interest rate, within a few years. For more immediate help (520) 222-6929 or info@MyOwnArizona.com

The MyOwnArizona™ Team Does More Than Help People Buy and Sell Tucson Real Estate

Mortgage Calculator:

|

|||||||||||||||||||

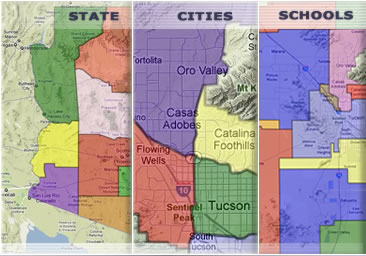

Real Estate Cities MLS Searches in Southern Arizona

- » All Arizona Cities

- Tucson AZ Real Estate

- Oro Valley AZ Real Estate

- Marana AZ Real Estate

- Green Valley AZ Real Estate

- Vail AZ Real Estate

- Sahuarita AZ Real Estate

- Benson AZ Real Estate

- Tubac AZ Real Estate

- Pearce AZ Real Estate

- Rio Rico AZ Real Estate

- San Manuel AZ Real Estate

- Sonoita AZ Real Estate

- Bisbee AZ Real Estate

- » All Arizona Types

- New Homes For Sale in AZ

- Land For Sale in Arizona

- Arizona Gated Communities

- Golf Communities in Arizona

- Horse Property For Sale AZ

- Condos Townhomes in AZ

- Retirement Communities AZ

- Lofts For Sale in Arizona

- Residential Income Property

- Commercial Real Estate AZ

- » All Arizona Communities

- Catalina Foothills in AZ

- Dove Mountain Real Estate

- Ventana Canyon Resort AZ

- La Paloma in Tucson AZ

- Sam Hughes Neighborhood

- Mt Lemmon Cabins in AZ

- Pima Canyon Estates

- Saddlebrooke in Arizona

- Sun City in Arizona

- Rancho Vistoso in Arizona

- Continential Ranch in AZ

- Stone Canyon in Arizona

- Civano in Arizona

- * Site updated twice daily.

» CALL (520) 204-4223 «

Tucson | Oro Valley AZ | Marana AZ | Green Valley AZ | Vail AZ | Sahuarita AZ | Benson AZ | Tubac AZ | Pearce AZ | Rio Rico AZ

New Homes | Land | Gated Communities | Golf Communities | Horse Property | Condos Townhomes | Retirement | Lofts | Residential

Catalina Foothills AZ | Dove Mountain AZ | Ventana Canyon AZ | La Paloma AZ | Sam Hughes | Mt Lemmon | Pima Canyon Estates

Saddlebrooke AZ | Sun City Vistoso AZ | Rancho Vistoso AZ | Continental Ranch AZ | Stone Canyon AZ | Civano AZ

AZ Foreclosures | Foreclosures in Tucson AZ | Tucson Short Sales | Oro Valley Foreclosures | Phoenix Real Estate

© Copyright 1995-2014. OwnArizona LLC. Tucson Real Estate. Oro Valley Real Estate. All Rights Reserved.